How To Secure

Big Premium Cases

in Just 6 Months

Without Cold Calling or Roadshows

Without Hunting for Leads

WHO AM I ?

Hi, it's Allen, I've help struggling tied-agents & FAs achieve breakthrough results in building profitable advisory businesses.

I've been recognized & awarded for being Performing Team for 3 consecutive years since being a team manager in 2020.

Why I'm Doing This

I've seen countless financial planners face the challenge of securing big premium cases. The traditional methods of

cold calling and roadshows often lead to rejection, low success rates, and a lack of substantial returns or qualified leads.

Significant investment in roadshows, costing thousands of dollars.

Limited success with sit-downs, yielding minimal outcomes.

Encounter low-quality prospects, resulting in small premium cases.

Experience free-look or lapse cases, causing clawbacks.

Numerous rejections faced during cold calling efforts.

Common phrases encountered:

"I already have an adviser / I'm not interested / Don't call me anymore."

Encountering ghost or airplane appts, leading to wasted time and effort.

Discover how my advisory team is

achieving big premium cases and working towards the MDRT dream

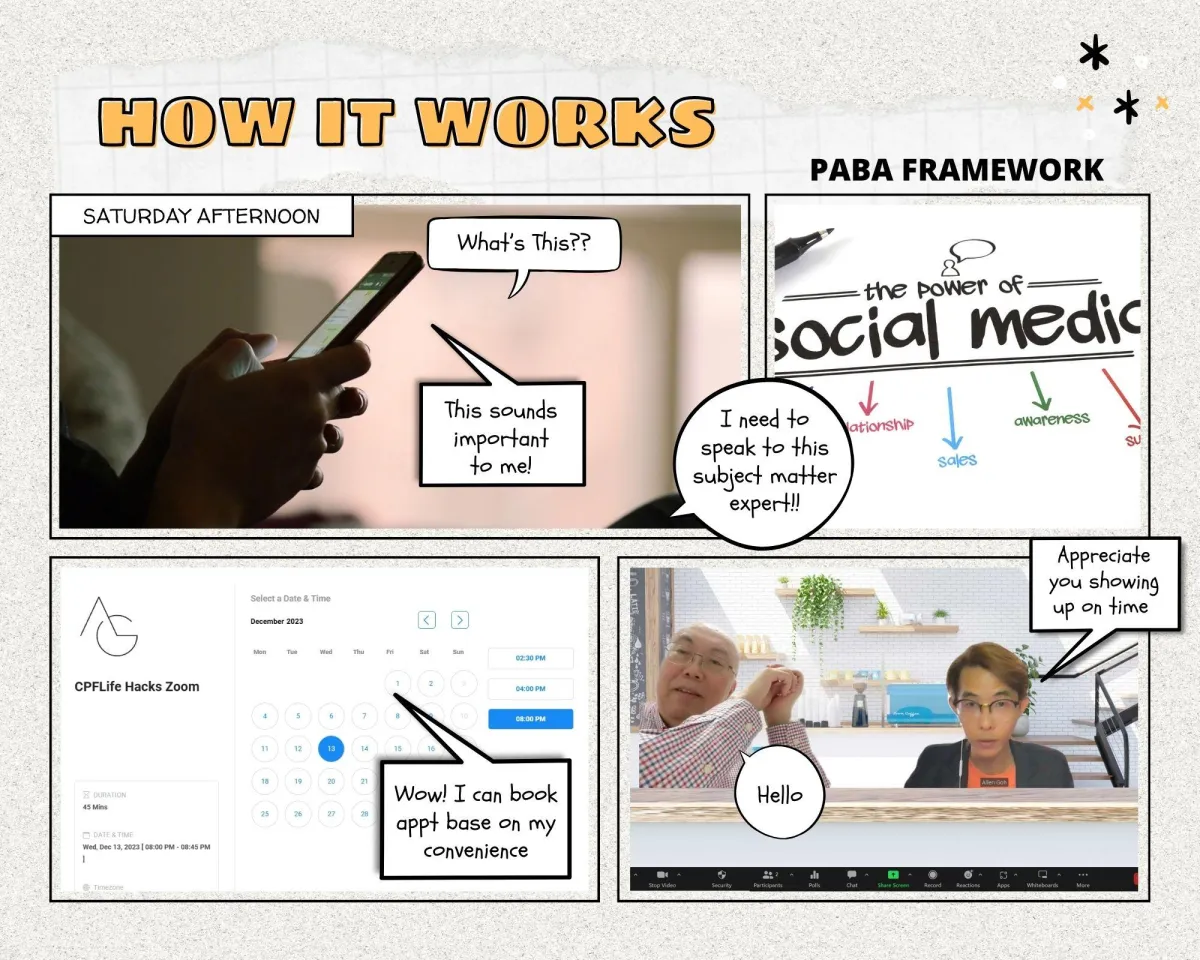

Introducing My Unique Framework [PABA]

Profitable Advisory Business Accelerator

This groundbreaking approach leverages AI technology

and harnesses the power of social media to reach

a wider audience of potential qualified leads

who are active on these platforms.

PABA In Action

How I Can Help You:

Setting up this automated system sounds costly and complex...

And yes, it's not easy work to set these all up...

Hang on, here's the key factor

I've done all the hard work of setting this system to benefit the advisors under my agency.

Because I know deep down this is exactly what every single advisor dreams of.

By tapping into the existing infrastructure & having it all DFY (Done For You)

The best part?

My DFY setup means no tech background required or intensive investment

Don't let rejection and low success rates hold you back any longer.

It's time to embrace a new way of doing things.

Prospects arrive with a clear understanding of their purpose for meeting you.

Achieve a remarkable 90% appointment show-up rate, indicating their commitment.

They enter meetings recognizing you as an authority and subject matter expert.

Show a willingness to attentively listen to your guidance and advice.

Willingness to disclose precise financial details, indicating trust and openness.

Ready and motivated to take actionable steps based on the information provided.

Exclusively for serious advisors looking to level up their business.

Due to the intensive amount of work provided to each new advisor.

If this page is online right now, then the spots are still available…

but not for long…

So, if you are determined to level up your financial advisory career and potentially hit your MDRT / COT in less than a year.

Reserve now as availability is limited.

We'll review and reach out to you.

WHAT PEOPLE SAY ABOUT ALLEN

"Allen's dedication, knowledge, & support have made a profound impact on my professional growth.

His coaching has not only enhanced my skills but has also boosted my confidence and motivation.

His knowledge, responsiveness, approachability, and understanding are qualities that set him apart.

His unwavering support and guidance have had a significant positive impact on my professional growth.

I am confident that he will continue to benefit not only me but the entire team."

Henry

"Allen always ready to share his experience and help the team any way he can. He is able to share a different perspective to my concerns, which I learnt a lot from.

Being in this industry for just 2 years and given the wide range of services the company provides to our clients, there are bound to be services where it is not my area of expertise.

Allen is willing to set aside his time to join me in any appointment to ensure that my client’s enquiries are attended to.

I feel reassured to have Allen as my manager because he's there whenever the team needs him."

Jun Jie (JJ)

HEAR

MORE

ABOUT

PABA FRAMEWORK

"I was skeptical at first, but Allen's approach using AI technology and social media has completely transformed my business.

I can't thank him enough."

"Since implementing his strategies, I've experienced strangers self-set appointments + genuine email enquiries seeking my assistance & knowledge for their concerns.

Without the awkwardness of picking phone to call or rejections since they are the ones that initiated contact.

It's truly been a game-changer."

PABA framework user

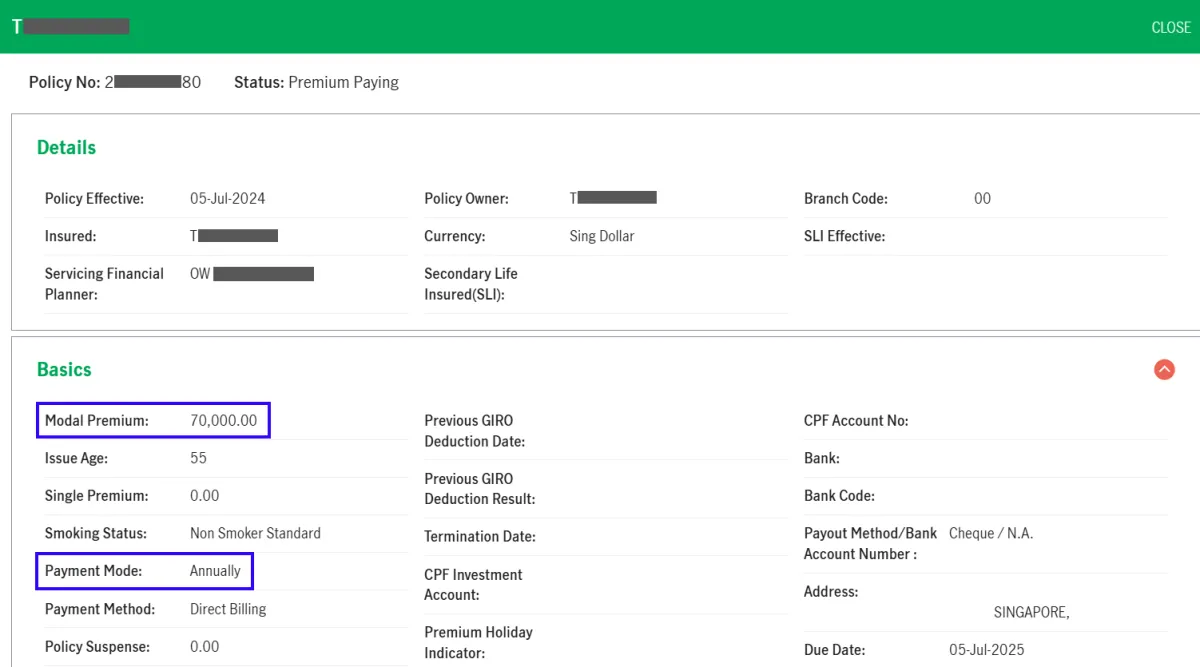

"Using the PABA framework transformed my sales approach.

I closed a $70,000 annual regular ILP in just two months!"

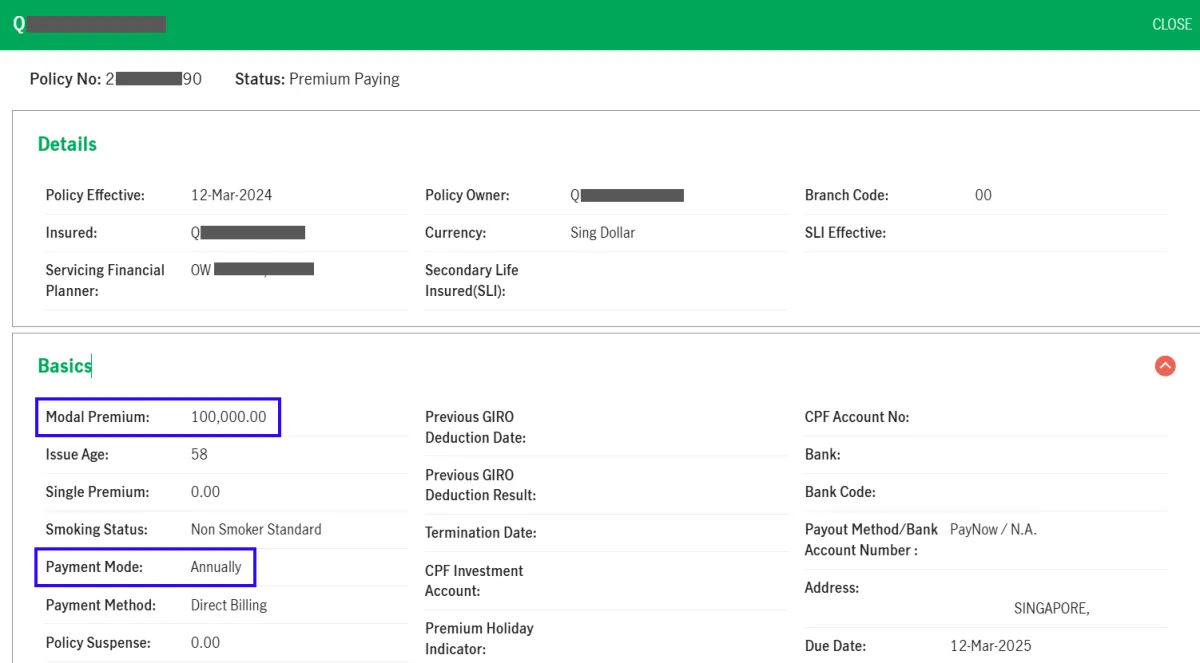

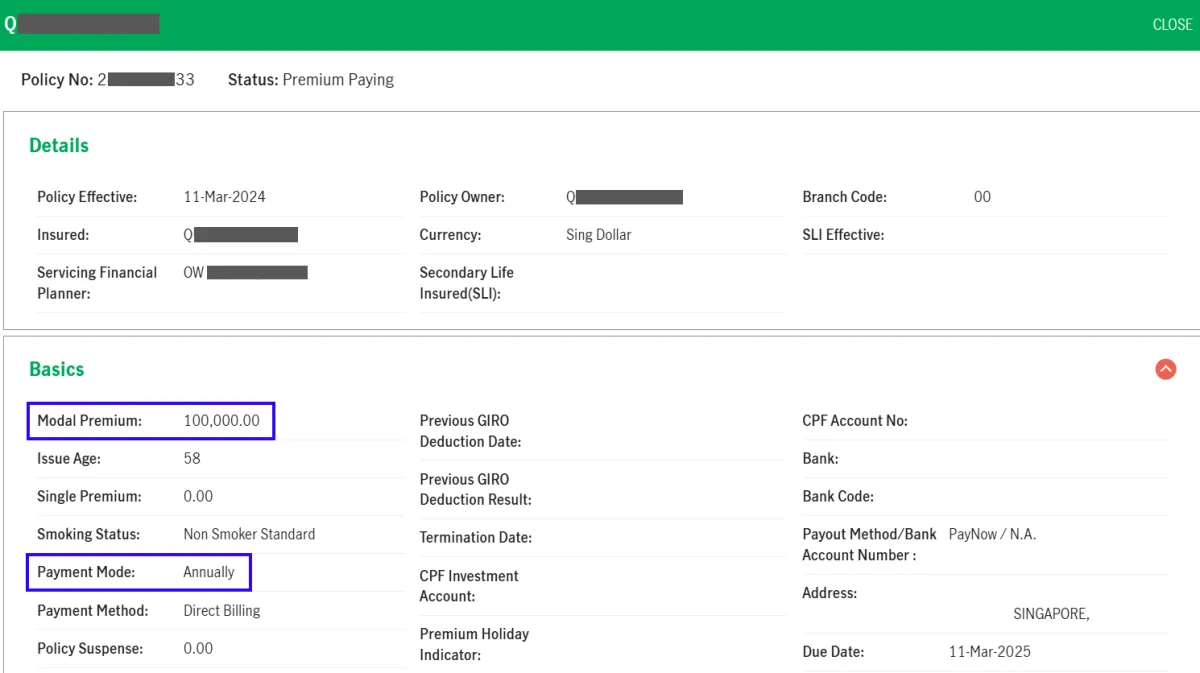

"By our 3rd meeting, he decided to get 2 identical plans base on his own financial housekeeping preference.

That's 2 cases of $100,000 cash each.

This framework really is just awesome"

"The most surprising outcome from using the PABA framework was its ability to attract QUALITY cold leads from public"

NOT CONVINCED?

HERE'S ANOTHER TESTIMONAL

Don't miss out on this opportunity to revolutionize your advisory business.

Submit your interest today and take the first step towards securing big premium cases and achieving your long-term goals!